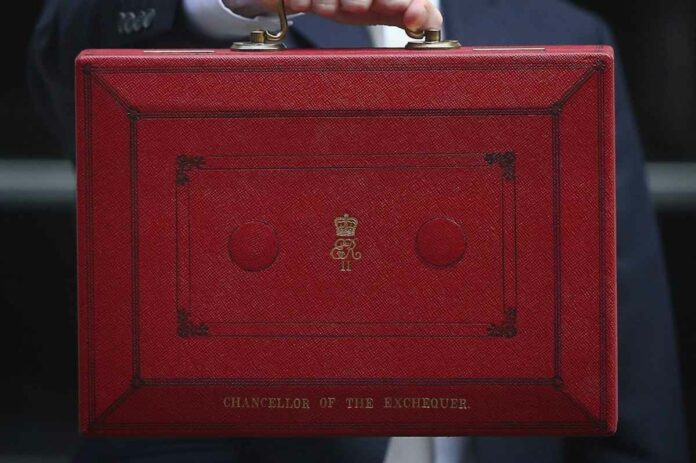

It’s fair to say that most autumn budgets tend to be met with trepidation in the UK, but the recent offering from Chancellor Jeremy Hunt had been dreaded like no other in recent memory.

After all, the budget commenced with confirmation that the UK had entered into a technical recession (this was confirmed by the Office for Budget Responsibility), while the ONS had previously confirmed that the rate of inflation had peaked at a 40-year-high of 11.1%.

But what exactly was in the recent budget, and how are the markets likely to react? Let’s get into it!

Table of Contents

OK, So What’s in the Budget?

This year’s autumn budget has come against the backdrop of a seismic economic crisis, which in the UK was exacerbated by former Prime Minister Liz Truss’s disastrous ‘mini budget’ that included sweeping, and untargeted, tax cuts.

Given that this sent the pound plunging to its lowest-ever level against the dollar and forced the Bank of England (BoE) to set aside a staggering £65 billion to help safeguard the pension and gilt markets in the UK (while also accelerating their quantitative easing program), it’s little wonder that it signaled the end for Truss and promoted a completely different economic strategy.

Ultimately, Chancellor Hunt and new PM Rishi Sunak have been considerably more cautious and collaborative this time around, while the latter has remained true to the policies that he broadly laid out during his previous Tory leadership campaign during the summer.

More specifically, tax rises and targeted spending cuts have been unveiled across the board, while the government has also lowered the threshold for the top rate of income tax from £150,000 to £125,000. This is expected to pull some 250,000 Brits into the 45p tax band, generating significant revenue for an ailing Treasury in the process.

Of course, the combination of tax hikes and stringent public spending cuts could exacerbate the impact of the recession in the short term, especially when you factor in the rising cost of borrowing and the potential for a housing market decline (it has been forecast that property prices may fall by up to 10% through 2023).

This will also lower the UK’s economic growth prospects for the coming years, with the recession expected to last for the duration of 2023 and inflation expected to remain above the BoE’s 2% target until some point in 2024.

However, the aim of the budget is to stabilize the macroeconomic climate and prevent the inflation rate from spiraling even higher, while restoring confidence in the markets and commencing the long and potentially arduous journey toward economic recovery and growth.

The Bottom Line – How Have the Markets Reacted?

While the Chancellor is ultimately responsible for delivering the budget (and Hunt has certainly produced a set of measures that are consistent with his previous pledges), this particular autumn statement had Rishi Sunak’s prints all over it.

After all, Sunak has spoken at length about how economic stability and reducing inflation are key to restoring growth, so he has clearly had input into a budget that will compound the quantitative easing efforts of the BoE and create a strategy that’s at least coherent and completely consistent.

It’s also hard to ignore the fact that Sunak and Hunt have conceived a conservative budget that’s aimed at restoring the confidence of the markets, with the PM having undoubtedly leveraged his contacts in the city to gauge the current market sentiment and factor this into his economic policy.

This certainly appears to have had the desired initial effect, as the statement has been welcomed as a credible and considered budget that will significantly boost the pound. This is good news for forex and currency traders, who can leverage spread betting and CFD products to speculate on short-term market price fluctuations.

Remember, the markets are big on credibility and tend to focus on short-term outcomes. So, despite the potential of this budget to compound the recession and damage long-term growth prospects, the financial markets will be far more concerned with the value of the pound and gilt yields performance in the aftermath of the announcement.

The pound is certainly expected to rally slightly against both the US Dollar and the Euro in the wake of the budget, especially as government debt is reduced and the Treasury’s income rises.

In the long term, this could also stall the BoE’s base rate hike program and consolidate or reduce the cost of government borrowing, creating the potential for a significant Tory win and a more positive market outlook over time.