It’s not always easy to talk about money. It can be especially challenging when we talk about lending or borrowing larger sums. When you urgently need additional funds you may turn to a reputable creditor, or decide to borrow from your friends and family. No matter what decision you make, it’s important to make a loan agreement to protect both parties. In this article, we are going to talk about the definition of a loan agreement and why it is significant to have one.

Table of Contents

What Is a Loan Agreement?

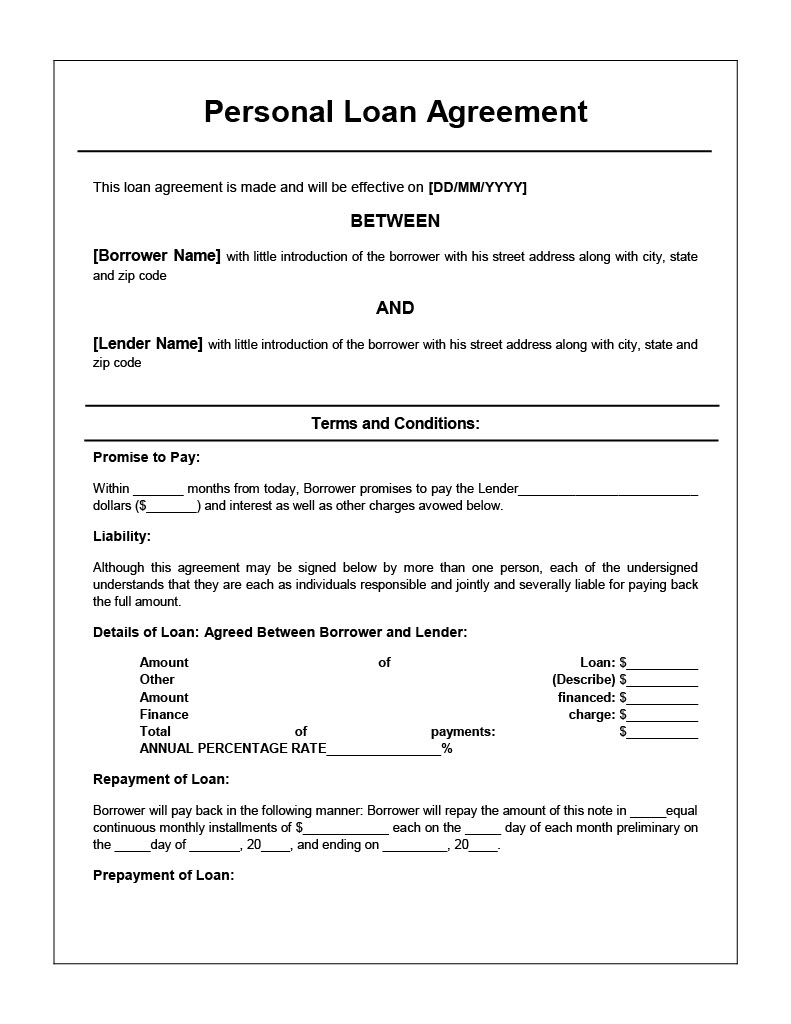

The loan agreement is a special document that legally binds the creditor and the borrower. This document is aimed at setting out the terms and conditions on which the creditor issues the funds to the borrower as well as the mutual obligations of both parties. This is a rather complex paper that is designed to protect the borrower and the lender.

Generally, it’s the lender who creates this contract and includes all the conditions and features of the lending solution. It’s equally as important for the borrower to understand all the nuances and details of this agreement to avoid pitfalls and possible mistakes. This document can protect you during the whole repayment period and answer any questions. Keep on reading to find out why you need to craft this contract.

Reasons for Making a Loan Agreement

It’s really essential to make this contract between the lender and the borrower so that both parties know the terms of lending funds. Before the crediting company issues the funds it will offer you to sign the contract that comprises all the details of your agreement and what you have agreed on. Whether you decide to take out money from physical lending institutions or use apps like Dave instead of local crediting, you will be offered to sign this agreement.

It will protect not only the lender and ensure his funds will be returned on time but also the borrower. The terms and conditions, as well as the interest rate, will be written in this contract so they won’t change during the lifetime of the loan and the borrower will also be protected. Creditors never want to issue their funds or lending services without crafting this legal document.

What is the purpose of this contract and why do you need it? Its purpose is to detail what you’ve negotiated with the creditor and mention all the nuances of the loan repayment process. This paper includes specific conditions that tell exactly the amount that is issued to the borrower and when this sum is expected to be returned. In other words, this is a legal promise between the borrower and the lender once this document is executed.

What Should a Loan Agreement Include?

This contract should include the following information:

- The sum of funds issued to the borrower

- The agreed repayment method

- The repayment term and time when the funds should be returned

- The interest rates and any additional fees

- The prepayment or late payment charges

- Nuances about collateral (in case of a secured loan)

It’s a big commitment to lend money so it’s really important to protect both the lender and the borrower. When you know all the details and have them written down on paper you feel more protected from unforeseen situations. This document doesn’t just mention the details of the lending conditions but also serves as proof of issuing the funds to the borrower.

What about family members or friends? More and more people prefer to borrow funds from their relatives or friends especially if they can’t qualify for traditional lending solutions. The local banks and conventional crediting institutions have strict demands and eligibility criteria. So, if your credit rating is less-than-perfect you may have trouble getting approved for a personal loan there.

Still, you need to sign a loan agreement even if a family member lends you some cash. You may think that a close relationship will protect you without any legal papers but it’s not true. In order to avoid unpleasant consequences, it’s always a good idea to act wisely and ensure you have no disagreement between you and both understand the terms.

Common Types of Loans

Whatever lending solution you choose, you need to create a loan agreement. Here are the main types of lending solutions you may opt for if you struggle to make ends meet or need extra financial assistance:

- General personal loans: they can be unsecured or secured. The first option doesn’t require any form of security or guarantee from the borrower. The second option required collateral to back the loan up. Although we’ve all experienced an economic recession during the COVID-19 pandemic, experts say that the growth of personal loan debt has decreased. The average personal loan balance was $16,458 last year, mentions Experian. You may utilize your auto or house as security. In case of nonpayment, the creditor will have the right to seize this collateral. On the other hand, unsecured loans usually has higher interest rates.

- Short-term loans: There are small amounts issued to the borrower for the short term. You may utilize these funds to cover unpredicted personal or business expenses. There are a lot of alternatives and even online crediting services that issue such short-term loans.

- Line of Credit: if you need to build a project and want to gain access to a certain sum you may choose a line of credit. You may request a specific sum but withdraw a smaller amount if you don’t need the rest. The rest of the cash will be still available during the whole period if you urgently require it.

- Overdraft: this lending solution is more suitable to business owners as it’s linked to their business accounts and allows borrowers to obtain extra money once their balance comes to zero. You only pay the interest on the amount you withdraw while only some overdrafts come with annual or monthly charges.

In conclusion, it’s important to understand all the details and terms of the loan agreement before you sign this document. It’s a legal paper that protects both the lender and the borrower. This document spells out the amount you withdraw as well as all the terms of repayment. Following the rules from this agreement, you will be able to avoid additional charges.