If you’re looking for new ways to invest, the space industry could be a perfect place to start. Billionaires, governments, and private sector firms are all racing to invest in space due to the massive potential for growth in the industry. We look at how to invest in space industry firms and which space companies to invest in.

Table of Contents

Before you start looking for space stocks to invest in, it’s important to understand why space stocks are currently so highly valued. For one, space tech is improving rapidly. The sector is estimated to be worth around $1 trillion by 2040, according to Morgan Stanley.

Billionaires interested in space also invest where their passions lie. Commercial space travel is a budding industry leading to a large influx of investment in space start-ups. With this in mind, here are some practical approaches for investing in space stocks and the best space companies to invest in.

As space investment stocks rise, there are a variety of ways to invest in space travel and space tech. Popular options currently include things like Venture Capital (VC) funds and space-themed ETFs. These methods have been popular with space investors in recent years.

Wondering how to invest in space industry stocks if you’ve got a few billion lying around? Pure-Play start-ups refer to an investment that has a single purpose, in this case, investing in space exploration. Usually, a pure-play start-up involves financing and setting up a space tech company yourself.

You can see examples of how to invest in space tech firms like this through people like Elon Musk and Jeff Bezos, who respectively founded SpaceX and Blue Origin. Already power players in financial terms, Musk and Bezos’s wealth allowed them to make a pure play in the space industry and put their money into space start-ups. This type of space investment is out of reach for most of us. But, if you’re a billionaire with dreams of reaching space, this could be one of the best space investments for you.

SPACs (Special Purpose Acquisition Companies) and IPOs have been incredibly popular in the space industry. A SPAC is a type of space investment trust that is privately financed for the acquisition of or merger with another company and that later goes public. When the fund is made public, ordinary investors are invited to buy shares. Space companies that have gone public include Virgin Galactic and Aerojet Rocketdyne Holdings. These firms are also some of the top space companies to invest in. Virgin Galactic is one of the most prominent players in commercial space travel right now.

Investing in ETFs, or Exchange Traded Funds is one of the more accessible routes if you’re wondering how to invest in space companies. An ETF is similar to a mutual or index fund, meaning investors can pool their money together. Some of the biggest space investment funds include Ark Space Exploration and Innovation ETF (ARKX) and Procure Space ETF (UFO).

Another great option for high rollers is private venture capital funds. These usually require a high starting investment for individuals but are a good entry point to the industry if you can afford it. If you’re interested in taking this route, consider funds such as Skyrora Ventures, Seraphim Space, or Space Capital.

Another way to invest in space is to put money into established firms that supply the industry. This can include tech and aerospace companies, such as Boeing or Lockheed Martin. You could also invest in companies like Raytheon Technology, Northrop Grumman, or Honeywell, among others.

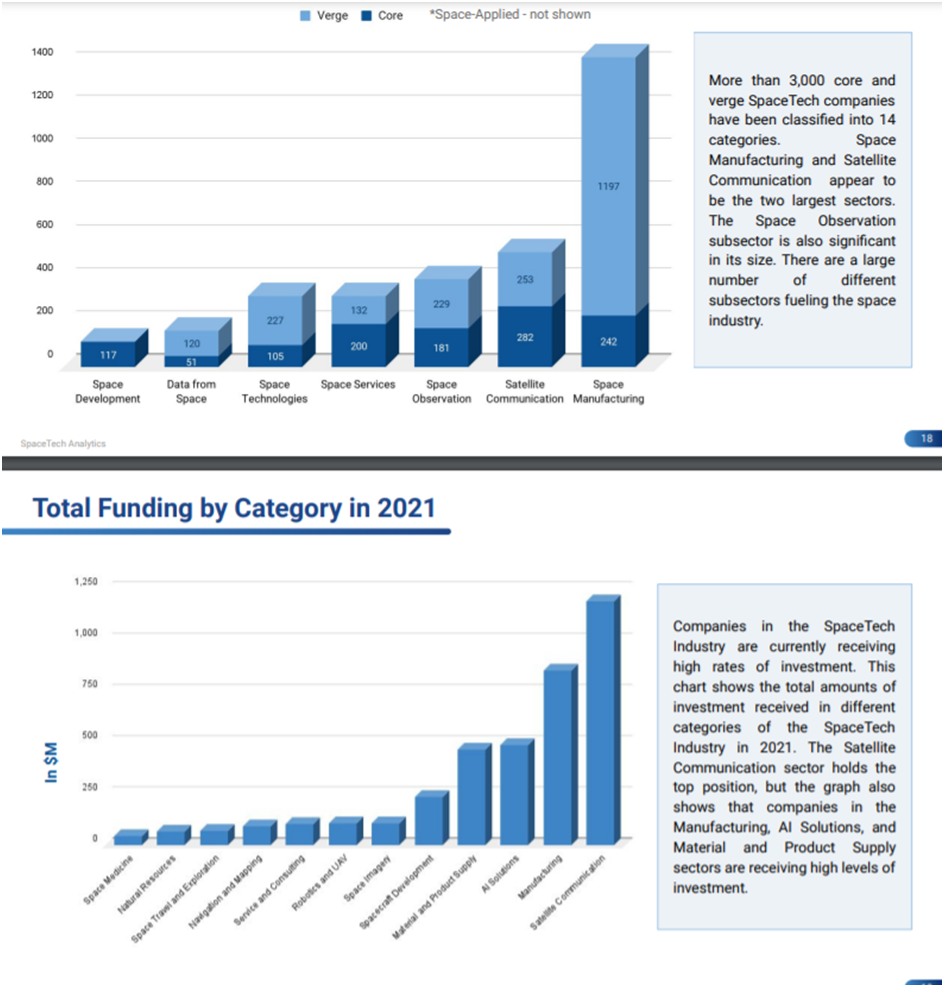

Once you’ve decided that investment is right for you, you should research the most attractive areas of the sector. Current trends suggest that manufacturing and satellite communications are two of the most viable parts of the industry. However, it is important to do your research and check recent reports on the sector.

One of the main barriers to entry into space investment is the money required and the risks involved. Many areas of investment require substantial sums, and it is yet to be seen if current growth patterns continue. If you intend to invest in space, try to plan for a long-term investment, which may hit some volatile patches early on. If you’ve been involved in investing for some time, you may recall some high-profile cases where space stocks underperformed or even collapsed. Instances of this include ventures like Iridium, Teledesic, and GlobalStar during the 1990s.

Those wondering how to invest in space stocks will find limited opportunities that don’t involve large amounts of capital. However, if you can afford it, space investments can be highly lucrative. It is wise to treat these investments as long-term ventures rather than ways to get rich quickly. It is also important to keep up-to-date with the market and find out which sectors are performing well.

Why Proper Export Packing Matters Exporting fragile and valuable items requires careful planning. Incorrect packing…

Pallet racking plays a central role in how a warehouse functions day to day. The…

Owning commercial property represents a significant financial and operational commitment. Whether the asset is a…

Exploring island beaches, diving locations, or the energetic city life are all amazing experiences when…

Growth in the mortgage sector requires more than increased case volume. Advisers must balance commercial…

Acoustics are crucial in any space, whether it's an office, classroom, or home workspace. Poor…