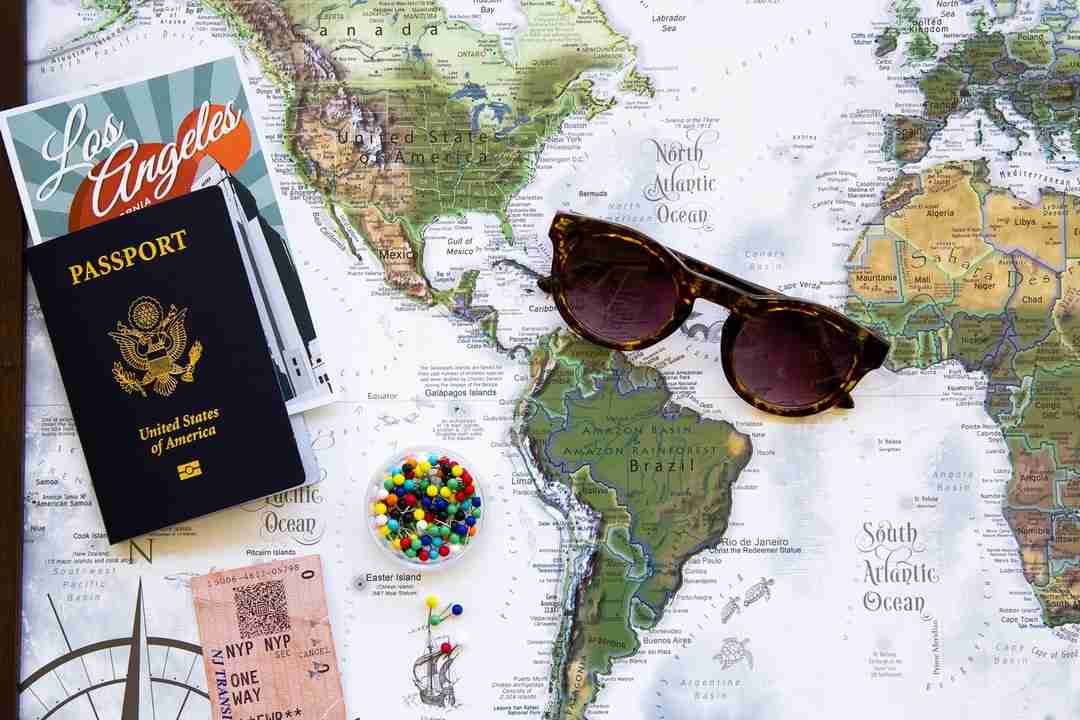

If you’re planning a trip or getaway, you may want to consider adding travel insurance to your preparations. Travel insurance is a policy that provides coverage for certain risks associated with travel, such as trip cancellation, loss of luggage, and medical expenses. Depending on the travel insurance company, it can also provide coverage for other things, such as a rental car to drive while you’re away.

When looking for the best travel insurance for your needs, there’s no one-size-fits-all answer for which travel insurance company is the best. The best travel insurance plan for your needs depends on your unique situation. However, there are a few factors to keep in mind when comparing policies. Today, we’ll explore these factors to help you find the best travel insurance for your needs.

Table of Contents

Many travel insurance plans are available on the market, and it can be difficult to determine which plan is the best for your needs. Before purchasing travel insurance, it’s important to understand the different types of coverage available and what each plan covers. Make sure to read the terms and conditions carefully to confirm if the policy meets your needs. Some policies only cover trips booked through a certain travel agency, while others do not cover pre-existing medical conditions.

The best travel insurance plan for your needs will depend on your travel plans. If you are traveling within your home country, a basic plan may be sufficient. Alternatively, if you are traveling internationally, you may need a plan with more comprehensive coverage. Some of the most common types of travel insurance coverage include medical expenses, trip cancellation or interruption, lost or delayed baggage, and rental car coverage.

When choosing a travel insurance plan, consider a plan that fits within your budget. Some budgeting factors to consider include the cost of the policy, the deductible, and the coverage limit.

The cost of the policy is the amount you will pay for coverage. The deductible is the amount you will have to pay out-of-pocket before the insurance company begins to pay for covered expenses. The coverage limit is the maximum amount the insurance company will pay for a covered event.

It would be best to find a plan that has a low cost, a low deductible, and a high limit. This will ensure that you are getting the best value for your money. Remember that these are all vital factors to consider when creating a budget for purchasing a travel insurance policy and planning your trip.

There are many types of travel insurance policies available, so choose the policy that matches your budget. The best travel insurance policy for you will directly impact the budget you plan for your vacation.

Another crucial factor to consider is how long your travel insurance plan will last. When choosing a travel insurance plan, ensure it covers you for the duration of your stay. The duration of travel insurance policies can vary. Some last for just a week, while others can be good for up to a year. So, be sure to check the policy’s time frame to ensure it covers the duration of your stay so you can rest assured that there won’t be a lapse in coverage.

It’s always an excellent idea to invest in travel insurance when planning a trip, whether it’s a vacation or business-related. With these tips, you should have no trouble picking the best plan for your needs.

Why Proper Export Packing Matters Exporting fragile and valuable items requires careful planning. Incorrect packing…

Pallet racking plays a central role in how a warehouse functions day to day. The…

Owning commercial property represents a significant financial and operational commitment. Whether the asset is a…

Exploring island beaches, diving locations, or the energetic city life are all amazing experiences when…

Growth in the mortgage sector requires more than increased case volume. Advisers must balance commercial…

Acoustics are crucial in any space, whether it's an office, classroom, or home workspace. Poor…