The wealthiest people are not those who have untold treasures, a lucky lottery ticket, or who inherited money from their grandmother. Even if it happened, the inability to properly manage money levels the luck and brings one more step closer to poverty.

A scrupulous attitude to money, its recalculation, and saving on the most essential things (treatment and care for your health) do the same. The rest can be adjusted.

We will teach you how to save money wisely and use affordable investment methods. You will learn about a helpful tool at the end of the material, making keeping the family budget even more effective.

Table of Contents

How to increase your money: top tips for saving money

First of all, cut down on clothing and food expenses. It doesn’t mean you should pick up crumbs from the table and drink only water. However, if you calculate everything ahead, a couple of dollars cheaper tea or coffee will help you save a decent amount at the end of the year, and that’s fifty dollars.

It’s just a tiny example of significant savings. Secondly, try to eliminate or reduce small expenses.

If you total up, you will find how much unnecessary stuff you bought or paid for. Donating the money to charity or putting it aside for a good purchase is better.

Top 5 tips for saving money:

- Buying less-promoted brands instead of well-known ones can save you money.

- Examine all the small (insignificant) spending that you do. It can be the delivery of groceries at home or to the post offices, even though you can use the point of delivery. Although you can find ways not to overpay, transferring money with a fee is simply lazy.

- Buy goods in batches or small bulk; it is much cheaper and, in the long run, will help you to save your budget: this applies to laundry detergent, toothpaste, soap, toilet paper, and even food.

- Use promotions not to save money on everything but to knock down the price of a very important item you want to buy. Also, use discounts and cashback for this purpose.

- Spend cash. It is proven that it is much easier for a person to part with unseen material goods, so he spends more than necessary on the plastic card.

It is the last tip on our list of super methods, but it gets results. Shop according to the list, and stick to it. Ultimately, be sure to use investment methods to replenish the family budget.

It is not necessary to have significant capital for this. Research the investment market and start putting money aside so that it is always in reserve.

Investments and other methods of passive income

For years, mankind has been worried about the same question – what to invest money in so that we never be on the threshold of poverty but to get rich and earn?

There is no exact answer to this question, and everyone is different. Although useful tools, modern programs and applications will help you save most efficiently.

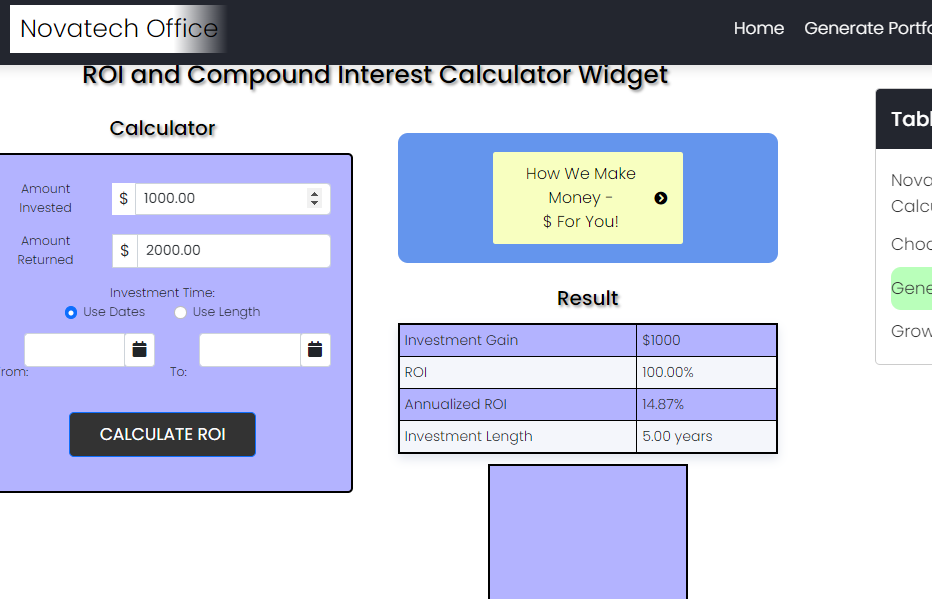

An investment calculator is a tool that will help you predict the return on investment and calculate the term, interest rate, starting capital, and the need for replenishment. You can use it with the Pocketguard app to make your money saving goal pay off every day

So, what can you invest money in to earn an income? Of course, cash under your pillow will bring you nothing but disappointment and a desire to spend it! Therefore, the surest ways to save and multiply capital are:

- currency or currency pairs on a brokerage exchange;

- gold bars and jewellery;

- a deposit account in a bank;

- buying stocks and bonds;

- real estate or a plot of land.

As we know, the end justifies the means, so set goals using special automated programs to calculate the results. Thanks to them, you will easily manage your finances rather than relying on chance.

The program itself will estimate how much interest needs to be paid on the loan, similar to the balance at the end of the month. It will remind you of any critical event regarding deductions or income.